Updated 10/24/2023

Whether this is your third ACA filing or your first filing; it’s never a bad idea to review the guidelines for ACA compliance. Especially if you are a smaller company, who is close to the ALE (Applicable Large Employer) threshold. In helping employers understand these basic IRS rules for ACA reporting, we want to point out that companies should view the federal requirement for employer reporting under the Affordable Care Act the same way they do the rule for W-2 submissions:

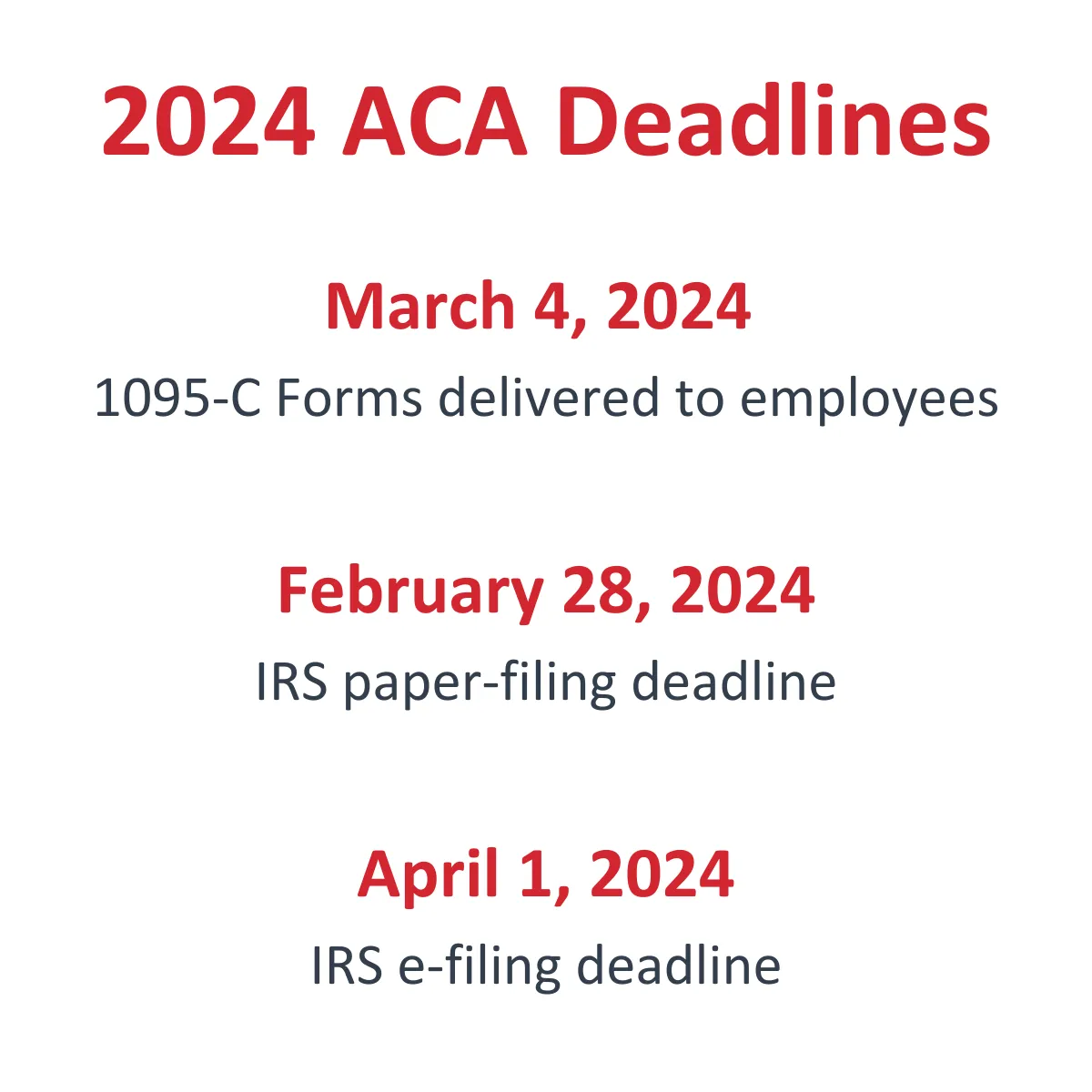

ACA returns are not optional and must be submitted on time. IRS deadlines for the new 1095-C and 1094-C forms mirror the annual reporting deadlines for W-2 and W-3 forms with the Social Security Administration. The non-filing fines are also identical: up to $580 per required form.

The intensity of what companies need to report on Form 1095-C and who they must produce a 1095-C form for differ greatly from W-2 guidelines. A strategy is needed – pronto! – for identifying where a company fits into the ACA compliance picture with respect to annual reporting.

Developing an ACA reporting strategy

The first thing a company must do is determine whether they are required to comply with the employer mandate of the ACA. Unlike submitting W-2s where all employers must submit employee withholdings, the reporting requirements under the ACA do not affect every company nor do all employees receive the new forms.

Determining a company’s ALE status

According the IRS, if an employer has at least 50 full-time employees, including full-time equivalent employees, on average during the prior year, the employer is an ALE (Applicable Large Employer) for the current calendar year. However, an employee will not be counted toward the 50-employee threshold for a month in which the employee has medical care through the military.

If your company was not in existence for all of the previous year, you are still required to comply if the average head count of the months you were in business was 50 or more full-time employees and equivalents.

Keep in mind that ALE status is not a once-and-done determination. This is calculated annually as part of your report to the IRS so they know each year which employers they can expect submissions from in the following year.

The ACA math for ALE determination

In analyzing the previous year, you calculate for each month the number of employees who worked 130 hours or more in that month. For employees who worked less than 130 hours, you total all those hours and divide by 120. That gives you the full-time equivalent.

Add the two numbers for that month. Calculate this for each month the company was in existence for that year, sum that number and divide the total by the number of months in existence. What you get is your ALE determination – the ACA acronym for who must comply: Applicable Large Employer.

To read this guidance as officially presented, click here for the IRS web page titled Determining if an Employer is an Applicable Large Employer.

If your company is part of a commonly controlled or affiliated group as defined by the IRS Section 414 rules, finding your ALE status gets a little more complicated. The calculation for all members of the group must be combined.

What the ALE math means for ACA compliance

Our company’s ALE number is under 50. Are we still required to comply?

No, if you go through this exercise, get a number under 50, and are a company that is not self-insured, there is nothing you need to do. The ACA employer mandate does not apply to you and you are not required to file for the ACA. However, if you are under the 50 FTE number, and are a company that is self-insured, you are still required to file ACA returns for all covered individuals regardless of the employee count.

I thought that 50 FTE was the magic number. So even though our FTE number is under 50, since our plan is self-insured we are still required to comply?

Yes, you are still required to comply per Internal Revenue Code, Sections 6055/6056. Regardless of your employee count, you are still required to file forms 1094-C and 1095-C.

We have completed the exercise, some months we are over 50 and other months we are under 50. Do we still need to comply?

You may still be required to comply. If you teeter on the 50 FTE number, there may be an opportunity to reduce this number by eliminating people whom the ACA does not define as employees. This includes employees who have medical care though the military. Please see our blog for more details.

Our company’s ALE number is over 50. Based on this article, I’m guessing we will need to comply. Is this correct?

Yes, you are correct. If you still hit the 50 FTE number, you will need to comply with the ACA employer mandate and provide the annual reporting to the IRS that verifies the status of your compliance.

Must-knows about ACA forms for employees

Where W-2s are provided to every employee who earned wages in the reporting year, ACA forms do not need to be provided to every employee. They are only provided to employees who were deemed eligible for access to health coverage during the reporting year.

A 1095-C will document, in monthly breakdowns, details of an employee’s access to health insurance sponsored by the employer, and of the coverage that the employer offered.

A W-2 must be produced to report withholdings for every employee who earned wages in the reporting year, unlike a 1095-C which must be provided only to every employee identified as eligible for an offer of health insurance during the reporting year. “Eligibility” – the ACA term for full-time status – hinges on hours of service to the employer, not just on paid hours on the job.

Also necessary to report on a 1095-C are attributes for the offer made to employees: Did it meet ACA coverage and affordability standards?

These differences create a tracking and record-keeping complexity that companies must be aware of and find a way to address immediately. Even the simplest compilation of the necessary monthly calculations – such as for a stable workforce, where employee schedules are predictable – exceeds what can accurately be captured on spreadsheets. The tracking task escalates in intricacy – and penalty risk – for workforces where employees’ schedules vary and turnover is frequent.

Help with filling out and filing ACA forms

To learn more about software that will auto-populate 1095-C forms for your employees and generate the file necessary to submit their transmittal, Form 1094-C, with the IRS:

- Watch Integrity Data’s ACA reporting webinar.

- Tour the ACA compliance section of our site.

Leave A Comment