Updated January 10, 2023

Penalties for IRS Filing Errors, Including those for Affordable Care Act (ACA) Returns are Significant.

You’ve been generous all along in providing health insurance to every one of your employees. Sure, you’ve heard about the Affordable Care Act’s employer mandate. And you’ve got the gist: Do right by this law to offer a certain standard of coverage – or pay the IRS.

Figure that you’re already compliant, so why sweat, right? All this fuss about some IRS forms for ACA compliance – that’s what less generous employers have to pay close attention to, right?

Not quite.

The letter of the ACA vs. the spirit of the ACA

Complying with the spirit of the Affordable Care Act isn’t enough. You’ve got to comply with the letter of the new health law, too. This added responsibility means that even when you’re doing right by your employees, you’ve got to document (through IRS forms to be submitted annually) that you are also compliant in this respect – in order to be fully ACA-compliant.

You need to document your compliance in monthly breakdowns. So let’s say that you had 50 or more full-time employees, including full-time equivalents. According to ACA regulations, you are an Applicable Large Employer, aka an ALE. As an ALE, you have to do Affordable Care Act information reporting at year-end for the IRS. That reporting includes documenting for the IRS that you offered health insurance to employees who met the ACA definition of full-time, and the attributes of that coverage.

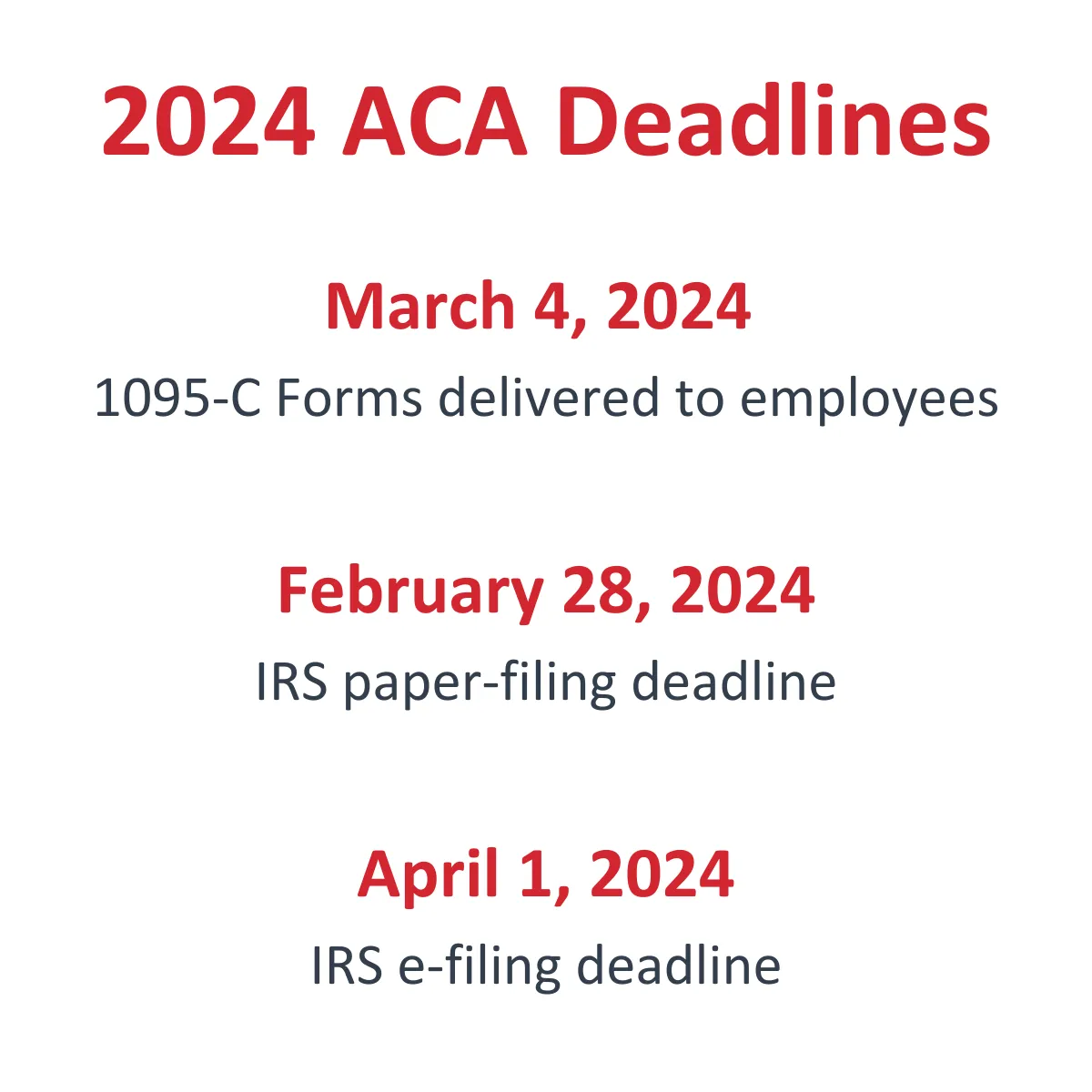

The reporting is done on two IRS forms: 1095-C and 1094-C. So for every month of the year, you need to be keeping records that, at year end, you’ll use to fill out one Form 1095-C for every full-time employee. Employees must receive this form by March 2 of each year. Then, by February 28 (if you paper file), you have to file all these 1095-C forms along with their transmittal, IRS Form 1094-C, to the IRS. If you’re e-filing, the deadline is March 31. These dates may move slightly each year depending on what day they fall. See deadlines at right for current year deadlines.

Or pay a significant fine per required return.

For decades, the penalty for failure to report correct information to the IRS was $100 per required return, with a cap of $1.5 million. Failure to report any information was $250 per required form, with a cap of $1.5 million.

ACA impact of the Trade Preferences Act of 2015 and Subsequent Decisions

But in the fine print of a global trade law that President Barack Obama signed June 29, 2015, came an unexpected wake-up call for all employers not dotting their i’s and crossing their t’s in any kind of IRS information reporting.

Under Section 806 of the Trade Preferences Act of 2015 (Public Law No. 114-27), legislation that provides job training and aid to U.S. workers displaced by globalization and foreign trade, there’s a provision that significantly increases penalties set forth in the Internal Revenue Code for filing errors. This provision was then “adjusted” by Rev. Proc. 2018-18, IRB 2018-10, sections 3.51(1), 3.51(2), 3.52(1), and 3.52(2) which decreased those penalties for failure to file correct information returns for returns required to be filed in 2019, and provide correct payee statements in 2019.

- $50 per information return if you correctly file within 30 days of the due date; maximum penalty $556,500 per year ($194,500 for small businesses).

- $110 per information return if you correctly file more than 30 days after the due date, but by August 1; maximum penalty $1,669,500 per year ($556,500 for small businesses).

- $270 per information return if you file after August 1 or you do not file required information returns; maximum penalty $3,339,000 per year ($1,113,000 for small businesses).

ACA fine now up to $570* per required 1095-C

The section in the trade law that lays out the penalty increases for non-compliant IRS filings applies to all IRS submissions, from W-2s to 1099s, and includes the ACA-mandated forms. The penalties affect nearly every disconnect in IRS submissions – from not providing corrected returns in a timely manner to intentionally disregarding the mandated submission.

An ACA return – in the form of IRS Form 1095-C – is required for:

- Every employee whose hours of service (not hours of work) total 130 in any one month of a calendar year (if you’re using the monthly measurement method to determine employee eligibility for health insurance)

- Employees in a stability period – those employees who, during a look-back period, were found to be full-time (if you’re using the look-back measurement method to determine employee eligibility for health insurance)

- Any employee who is on an employer-provided health insurance plan – even if that employee was not full-time in any month of the calendar year

And just as a W-3 is the transmittal for W-2s, there’s IRS Form 1094-C that’s the transmittal for Form 1095-Cs to the IRS.

There’s no IRS grace for not filing the ACA forms:

- If you’ve been offering coverage all along that now also has the ACA stamp of approval, you’ve still got to produce Form 1095-C for employees and file Form 1094-C for the IRS.

- If your ACA strategy is to “pay” – accept what’s called the IRS sledgehammer penalty for choosing not to offered the required health coverage – you’ve still got to produce Form 1095-C for employees and file Form 1094-C for the IRS.

With respect to the ACA forms, there’s IRS grace if you follow through with the mandated submissions (“a good faith effort”) and happen to have filing errors.

Are you confused about ACA Measurement Periods?

Learn more by watching our ACA 201 video, “Determining Eligibility for Health Coverage“

Related post: Take cover from the ACA sledgehammer and tack hammer penalties

*Penalty amounts are subject to change for each filing year

Leave A Comment