Updated September 15, 2020

Updated September 15, 2020

After a turbulent first year with the new administration in charge, the ACA Employer Mandate still stands and therefore so do all the IRS reporting requirements around it.

As 2020 comes to a close, here are some interesting observations we have made since we first started with ACA compliance solutions in 2012, around US employers reacting to the law: who cares and to what extent?

Which employers must be ACA–compliant? AKA: Who needs to care?

According to ACA rules, employers are required to file yearly reports with the IRS when, in the previous calendar year, their organization:

- Employed 50 or more full-time employees, including full-time equivalents

- Was self-insured (then the number of employees is irrelevant)

These employers are called “Applicable Large Employers” or ALEs.

If you have been living under a rock all these years, OR have been in denial, hopeful that a repeal would happen, OR are new to ACA employer compliance, OR think your employee count may hit 51+ this year – we hear you. ACA reporting for employers can be easy. Use our flowchart find out how ACA rules apply to your organization.

Are there distinctions between employers? AKA: How much do I need to care?

When we first began talking with employers about Affordable Care Act compliance in early 2012, the employer would bring up: “This law is coming and we are in T.R.O.U.B.L.E!” These employers are part of what we call the Forced Minority – companies with a workforce defined by hourly workers with varying schedules and/or high turnover, often with low wage workers. Because of the ACA, these companies were “forced” to either offer coverage for the first time or expand their existing offering to a wider employee base. This segment of U.S. employers first worries about identifying their employees eligible for health insurance – so they can get offers out pronto – and later sort through IRS reporting details of the coverage offers.

- Penalties are top-of-mind for the Forced Minority. They are aware that, by offering limited or no health insurance, they are vulnerable to significant financial consequences under the ACA employer mandate. In particular, they are at risk of the ACA coverage penalties for offering no coverage and/or for offering coverage that does not meet value or affordability standards.

- They know they need help in getting at and tracking their workforce data in a detailed way year-round in order to avoid or minimize IRS non-compliance fines.

Our discussions with employers about ACA compliance have broadened since then. Often, we are the ones bringing up talking points that are still not top-of-mind for the employer. These employers are part of what we call the Burdened Majority – those employers who aren’t worried about who to cover because they already cover everybody. Their sole worry about ACA compliance is filling out IRS Forms 1095-C and 1094-C: the yearly statements for their employees and the IRS.

- Employers in the Burdened Majority dismiss talk of penalties: “How can you be ACA non-compliant if you’re offering coverage that provides quality beyond what the law mandates?”

- Many of these employers are unaware that they need to get at their data for monthly breakdowns. Nor are they aware that, if they don’t file the new IRS returns, they will face the IRS non-filing penalty – $550* per required return. This penalty is assessed for willful disregard of any information reporting requirements, including those for ACA returns. For late filing or erroneous filing, the penalty is $270* per required form.

The Forced Minority cares the most but so should the Burdened Majority! AKA: All ALEs should care.

By now, most US employers understand that if they have 50 or more full-time employees, including full-time equivalents, they must offer coverage of a certain standard to certain employees or face a penalty. However, it is difficult for employers who take pride in their both their conscientiousness and their generosity to come to terms with the fact that, in the ACA age, they must file the same IRS forms intended for assessment of penalties against employers who offer limited or no coverage.

Preparedness, then, for ACA reporting remains low among these employers – even though compliance with this federal law became enforceable as of January 1, 2015 and is, in fact, being enforced by the IRS.

OK, OK I care – now what should I DO?

We are already 2+ months into 2020 so time to get on the bandwagon!

Continuously: ALL employers must track every employee’s hours of service (not just paid hours of work on the job) – year-round.

All employees – exempt and non-exempt – must have their hours of service tracked. Factored into the hours of service calculation are such matters as jury duty, military duty and FMLA absences.

Sure, this is not as huge deal for the Burdened Majority as it is for the Forced Minority, but keeping records remains important, even if they are (almost) the same every month!

Monthly: Employers must also track what coverage was offered and whether an employee accepted any coverage.

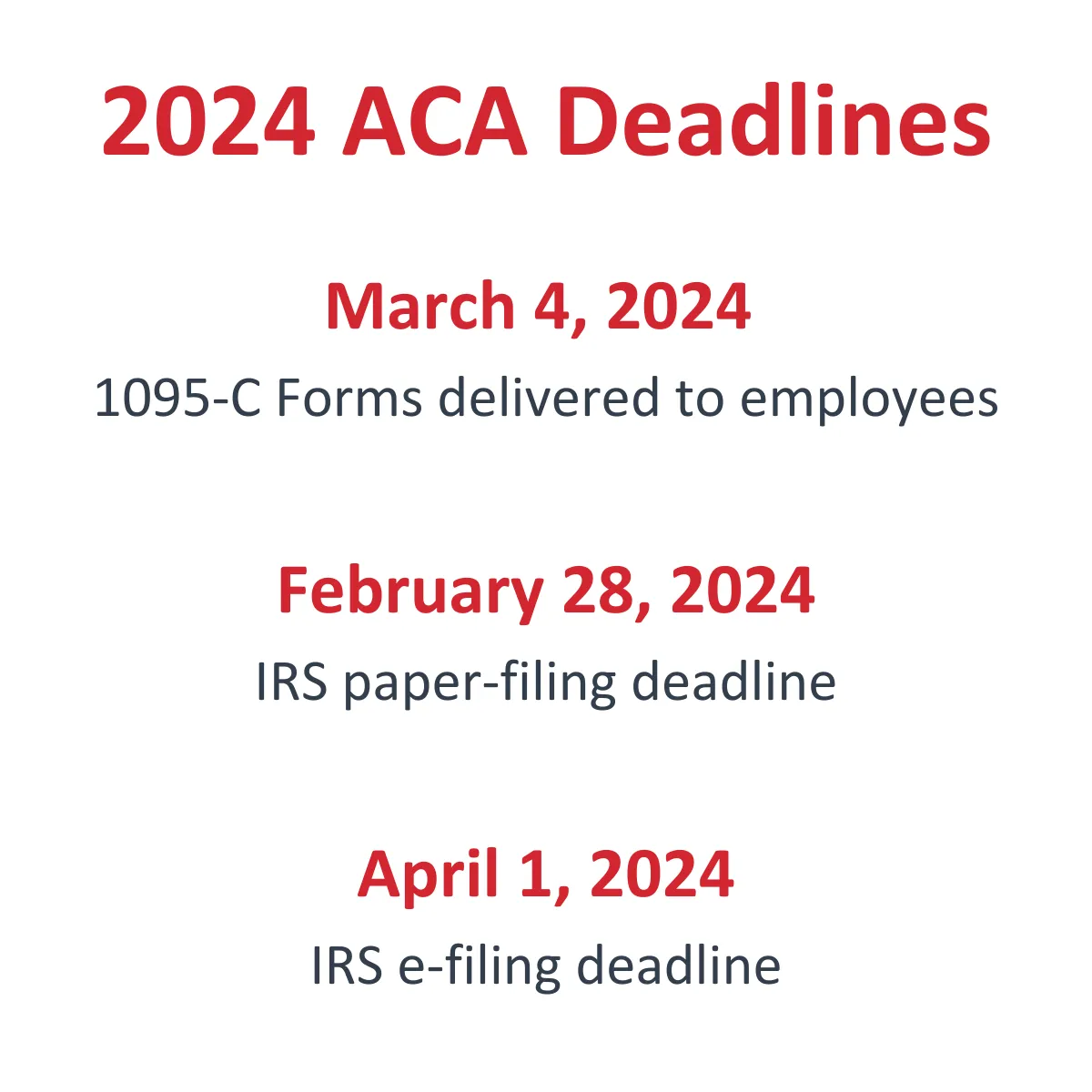

Annually: By January 31, employees who are eligible for coverage from their employer, or who have coverage from their employer, must get their copy of Form 1095-C. By February 28, the employer’s copies of the 1095-C forms must be transmitted to the IRS with a respective 1094-C transmittal form. If you are electronically filing, 1094-Cs are due to the IRS by March 31.

Note: These dates may change each year depending on if the dates fall on a weekend, if or there is an IRS extension.

See ACA Deadlines below for current year dates.

Preparing now to generate these IRS forms is key.

The detailed record-keeping involved in producing Forms 1095-C and 1094-C is not a job for spreadsheets. Automation is needed to ensure accuracy. If you are happy with your current ACA Compliance solution – great! If not, Integrity Data can help – now is the time to engage us to do the whole thing for you!

To learn more about Integrity Data’s ACA tracking and ACA reporting service:

- Watch our on-demand ACA webinar for employers.

- Or contact our ACA compliance team.

*subject to change each filing year

Leave A Comment